Artificial Intelligence (AI) is transforming industries across the globe, and the banking, financial services, and insurance (BFSI) sector is no exception. The global AI in banking market is expected to grow from $4 billion in 2021 to $64 billion by 2030, reflecting a 35% compound annual growth rate (CAGR), according to research from Insight Partners.

From enhancing customer experiences to strengthening risk management, AI’s role in the financial sector is growing rapidly. Despite the benefits, a survey by PwC revealed that 52% of financial services firms cite legacy systems and data fragmentation as the primary roadblocks to AI adoption. At Celestial Systems, we understand these hurdles and have positioned ourselves as a trusted partner for financial services organizations looking to navigate their AI journey effectively.

AI’s Growing Role in BFSI

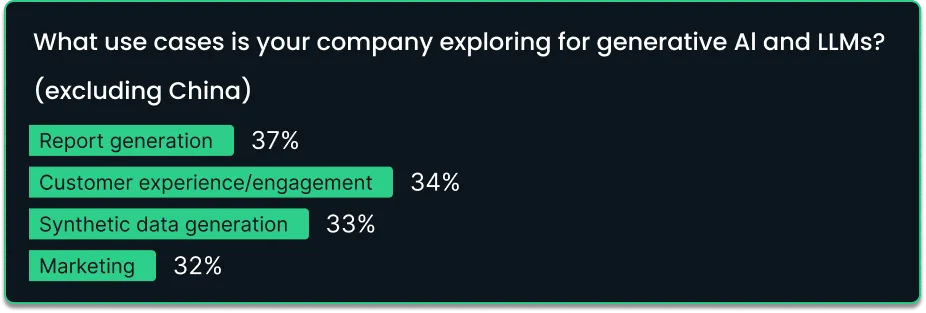

Financial institutions are increasingly leveraging AI-driven technologies across various areas of their business. For example, AI-powered customer service tools like chatbots and advanced mobile banking apps are helping banks streamline communication with customers. Generative AI (GenAI) takes this even further by enabling real-time interactions with minimal human intervention, while also capturing data that can be used to enhance services.

Another area where AI is making a significant impact is personalization. AI allows financial institutions to analyze customer data more effectively, enabling them to offer highly personalized financial products, budgeting tools, and investment advice. This level of personalization not only enhances the customer experience but also drives deeper engagement and loyalty.

Source: NVIDIA – State of AI in Financial Services

In terms of risk management, AI is proving to be a game-changer. It helps institutions manage both cybersecurity threats and financial risks. AI-infused cybersecurity solutions can monitor for potential threats and distinguish between those requiring human attention and those that can be handled autonomously. For an industry that is often a prime target for cybercriminals, these advancements are invaluable.

The Roadblock: Legacy Systems

Despite the promise of AI, many financial institutions are struggling to fully adopt these technologies. The biggest challenge? Legacy systems. Financial services organizations often have a complex web of outdated infrastructures, multiple technical stacks, and scattered data sources. These fragmented systems make it difficult to harness AI’s full potential. Before these institutions can fully embrace AI, they need to modernize their infrastructure and consolidate their data.

At Celestial Systems, we help financial services organizations overcome these barriers. With our deep expertise in digital transformation and cloud solutions, we ensure our clients are AI-ready faster and more effectively. Our partnership with Microsoft Azure and Dataiku allows us to provide cutting-edge solutions that accelerate the transition from legacy systems to modern, AI-powered environments.

Meeting the Demand: Who We Are Hiring

As the demand for AI solutions in the financial sector grows, so does the need for skilled professionals who can drive these transformations.

At Celestial Systems, we are actively expanding our team to meet this demand. Here are some of the key roles we’re hiring for:

- Data Scientists: With expertise in Python, R, and data analytics, our data scientists help financial institutions unlock the potential of their data to create actionable insights.

- DevOps and Security Specialists: From cloud security to security testing, these professionals are critical in ensuring that AI solutions are deployed securely and reliably.

- Cloud Engineers: With experience across Azure and AWS, our cloud engineers help modernize financial institutions’ infrastructure, enabling them to scale and adopt AI technologies with ease.

- Full Stack Developers: These experts ensure that all layers of applications—from the front-end user experience to the back-end architecture—are optimized for AI-driven solutions.

The BFSI sector is experiencing a surge in the demand for tech-driven tools, particularly in areas like fraud detection, online banking security, and personalized financial services. Our own hiring trends reflect this growing need, and we’re committed to building a team that’s equipped to address these evolving challenges.

Tips for Candidates Preparing for FinServ Tech Roles

Develop a Strong Foundation in Data Analytics

Financial services organizations rely heavily on data-driven decision-making. Candidates should focus on building expertise in data science tools like Python and R, and familiarize themselves with data visualization platforms like Power BI or Tableau. Understanding data models and financial analytics will give them a significant advantage.

1. Gain Experience with Cloud Platforms (Azure & AWS)

With the financial sector rapidly moving to cloud infrastructure, proficiency in platforms like Microsoft Azure and AWS is a must. Candidates should gain experience with cloud architecture, DevOps tools like Kubernetes and Docker, and cloud security best practices. Certifications in Azure Fundamentals, Azure AI Engineer, or AWS Certified Solutions Architect can make candidates stand out.

2. Understand the Financial Services Domain

While technical expertise is essential, a solid understanding of financial systems and the unique challenges of the BFSI sector is equally important. Candidates should familiarize themselves with regulatory requirements like GDPR, risk management frameworks, and key industry trends such as digital banking and fraud detection.

3. Get Hands-On with AI & Machine Learning Projects

Experience with AI and machine learning is highly sought after. Candidates can stand out by working on real-world projects, like building predictive models for financial data or exploring AI for cybersecurity. Participating in hackathons, open-source projects, or AI research focused on BFSI use cases will demonstrate their hands-on capabilities.

4. Prioritize Security Skills

Security is paramount in the financial services industry. Developing expertise in cloud security, application security, and threat detection will be key for roles related to DevOps and AI. Candidates should stay up-to-date with industry standards, cybersecurity tools, and practices like ethical hacking and security automation.

5. Sharpen Soft Skills

As financial institutions prioritize digital transformation, communication and collaboration are becoming increasingly important. Candidates should hone their problem-solving, communication, and project management skills, as they’ll be working cross-functionally with stakeholders from various departments, including IT, business, and risk management.

6. Certifications and Learning

Candidates should continuously invest in upskilling through industry certifications. For example:

- Certified Information Systems Security Professional (CISSP) for security roles.

- Microsoft Certified: Azure Data Scientist Associate for AI and data roles.

- AWS Certified Big Data – Specialty for cloud data management. These certifications not only demonstrate expertise but also show a commitment to staying current with the latest technologies.

- Dataiku Certification for AI Designer, MlOps practitioners etc. makes it easy to handle some of the intricate machine learning concepts and put forth them in model building a seamless job.

7. Network with Industry Experts

Attending financial services tech conferences, participating in online communities, and staying active on platforms like GitHub and LinkedIn can open doors for job opportunities. Networking with professionals in the industry can also provide insights into the challenges faced by FinServ organizations, helping candidates align their skills with industry needs.

Why Join Celestial Systems?

At Celestial Systems, we’re not just helping financial institutions adopt AI—we’re shaping the future of the financial services industry. By joining our team, you’ll have the opportunity to work on transformative projects that leverage the latest in cloud, data, and AI technologies. If you’re passionate about using technology to solve real-world challenges, we want to hear from you.

Interested? Please check out open positions and/or follow us on LinkedIn.