Generative AI, or GenAI, is reshaping industries. A 2024 survey conducted by Dataiku and Databricks reveals that 90% of senior AI professionals are already investing in GenAI, either through dedicated budgets or existing IT and data science allocations.

Financial Services, or FinServ, are no exception. From automating routine processes to empowering data-driven decisions, this technology is modernizing how FinServ teams operate. While AI tools like RPA and predictive analytics have already gained traction, generative models take it further—enabling dynamic content creation, automated forecasting, and risk modeling at unprecedented scales.

But how exactly can FinServ teams utilize GenAI to transform their workflows?

What is Generative AI and its Role in FinServ?

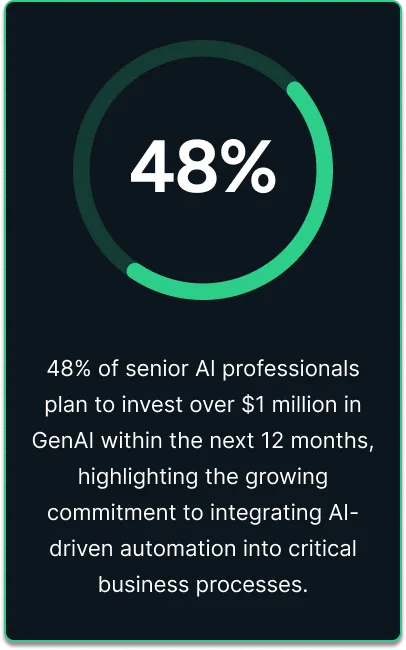

GenAI refers to a class of machine learning models that can develop new data similar to a given dataset. According to the same survey,

48% of senior AI professionals plan to invest over $1 million in GenAI within the next 12 months, highlighting the growing commitment to integrating AI-driven automation into critical business processes.

GenAI, driven by deep learning and transformer models like GPT, is transforming the FinServ sector by generating human-like text and automating complex tasks. It excels at processing structured data, such as accounting ledgers, and unstructured data, like market news. It allows it to sift through vast information and deliver insightful outputs that FinServ professionals can act on for timely decision-making.

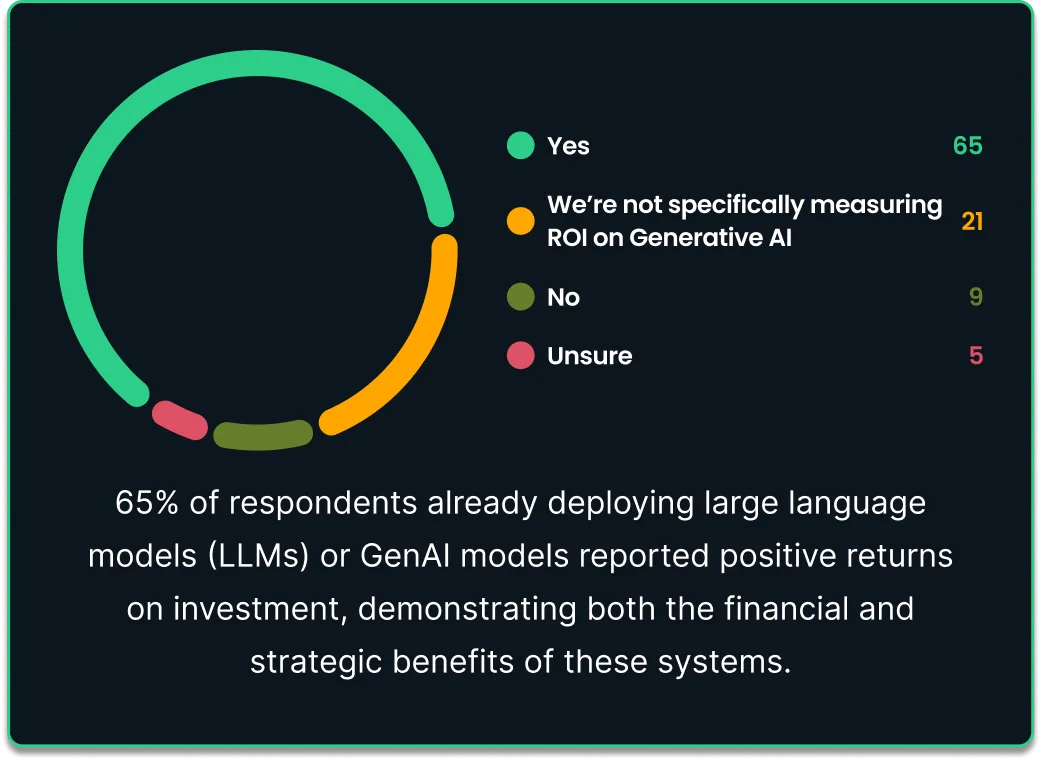

65% of respondents already deploying large language models (LLMs) or GenAI models reported positive returns on investment, demonstrating both the financial and strategic benefits of these systems.

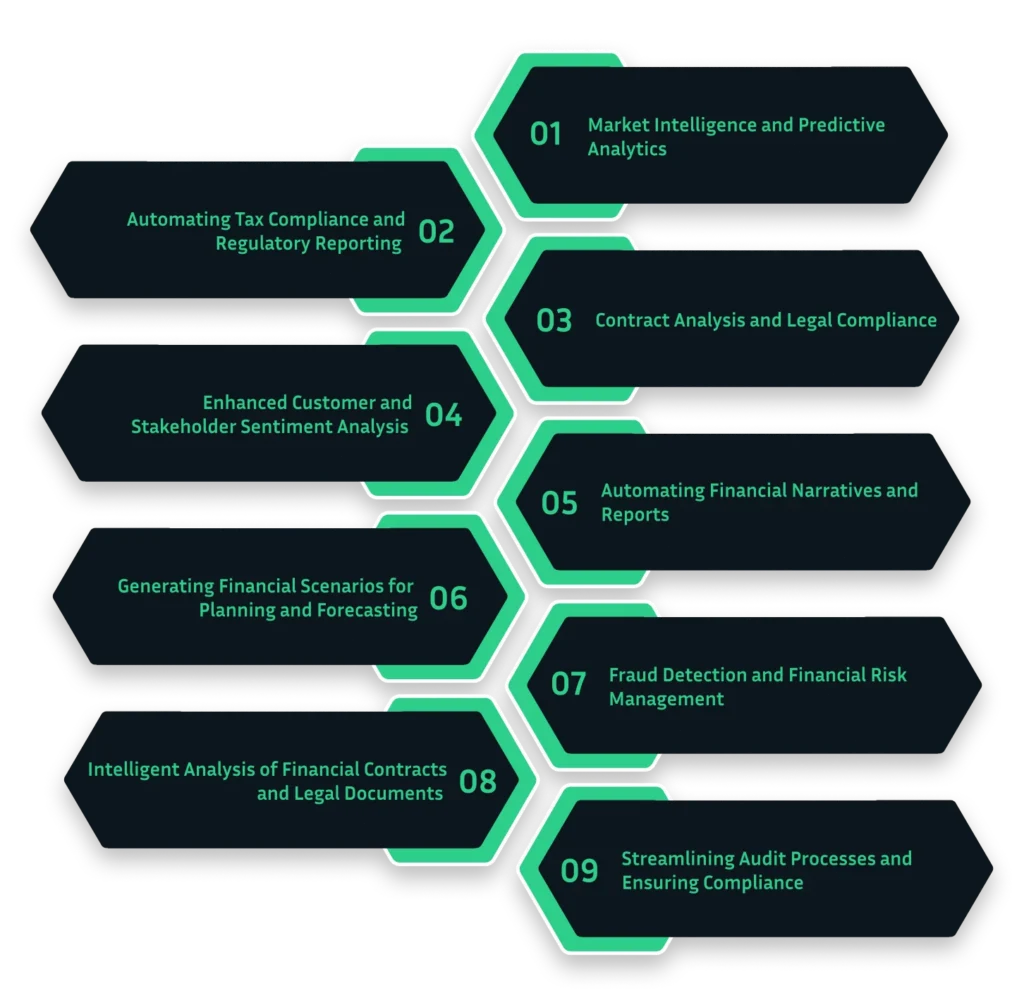

Key Use Cases of Generative AI in FinServ

Market Intelligence and Predictive Analytics

GenAI enables FinServ teams to gain deeper insights into market trends and dynamics. AI can synthesize data from multiple sources—such as news reports, competitor activities, and industry forecasts—into actionable intelligence through advanced data analysis. Additionally, predictive models created by GenAI can forecast market behaviors and inform strategic planning, giving companies a competitive edge.

Automating Tax Compliance and Regulatory Reporting

GenAI automates the analysis and generation of tax documents by scanning regulatory changes and applying them to a company’s financial records. It ensures accuracy and timely filing, minimizing non-compliance risks and associated penalties. FinServ professionals can also benefit from AI’s ability to produce detailed regulatory reports with minimal manual intervention.

Contract Analysis and Legal Compliance

FinServ teams are frequently tasked with reviewing complex contracts, a time-consuming error prone process. GenAI can automatically extract critical clauses, terms, and conditions from contracts. It can flag potential risks, ensure legal compliance, and streamline contract lifecycle management. By automating these tasks, FinServ teams can devote more time to strategic negotiations and risk mitigation.

Enhanced Customer and Stakeholder Sentiment Analysis

Understanding customer feedback is crucial if you are aiming to align your strategies with market expectations. GenAI can process large volumes of unstructured data, such as customer reviews, social media posts, and surveys, to provide insights into market sentiment. By detecting patterns and trends in customer behavior, AI enables FinServ teams to refine their approach, improve product pricing strategies, and predict customer needs, thus aligning financial strategy with real-time market feedback.

Automating Financial Narratives and Reports

FinServ teams often spend considerable time creating financial commentaries and reports. GenAI can streamline this process by interpreting raw data and turning it into structured, insightful financial reports, ranging from quarterly earnings statements to in-depth market analyses.

Generating Financial Scenarios for Planning and Forecasting

GenAI supports Scenario planning and forecasting by creating multiple financial scenarios based on historical data, economic indicators, and industry trends. FinServ teams can quickly assess potential outcomes of strategic initiatives, mergers, or acquisitions, be prepared for the future, and make informed decisions backed by AI-generated forecasts.

Fraud Detection and Financial Risk Management

AI models excel at identifying patterns of behavior that may indicate fraud or financial risks. By continuously monitoring transactions and financial data, GenAI can find out anomalies that may be missed by traditional methods. These systems can flag suspicious activities, enabling faster investigation and reducing the impact of fraud. Similarly, AI models provide a more comprehensive view of financial risks, helping companies better anticipate and mitigate potential losses.

Intelligent Analysis of Financial Contracts and Legal Documents

FinServ teams often deal with complex contracts and legal agreements that require careful scrutiny. GenAI can intelligently extract relevant clauses, terms, and conditions, simplifying the review process. Doing this accelerates contract negotiations and reduces the risk of oversight or misinterpretation.

Streamlining Audit Processes and Ensuring Compliance

Auditing is a critical yet resource-intensive function for FinServ teams. GenAI can automate many aspects of the audit process, from data collection to compliance checks. AI-driven audit tools can cross-reference financial records against internal and external regulations, flag discrepancies, and ensure the accuracy of financial statements. It reduces the time and effort required for audits while improving their precision.

Benefits: Why FinServ Teams Should Embrace Generative AI

Increase Operational Efficiency: Automating labor-intensive processes allows FinServ teams to focus on strategic, value-adding activities. Tasks like tax filings, compliance documentation, and even auditing can be streamlined.

Reap Strategic and Financial Value: 65% of companies with GenAI models in production are already seeing positive financial returns. This shows that GenAI is also providing direct financial benefits to companies willing to adopt it, beyond the operational efficiencies.

Make Smarter Decisions: GenAI provides financial services leaders with data-driven insights that improve decision-making processes. By continuously learning and updating from new data inputs, AI delivers real-time, actionable intelligence.

Cut Costs: AI can significantly lower your operational costs by automating tasks and reducing errors, especially in areas like risk analysis and compliance management.

Improve Scalability: With your business, grow the complexities. GenAI models are scalable and capable of handling increased workloads without needing additional manpower. They adapt to growing datasets and evolving financial conditions seamlessly.

Challenges and Solutions: Overcoming AI Adoption Barriers

Here are a few more challenges and how to solve them:

Data Privacy: With vast amounts of sensitive data, FinServ teams must ensure AI systems comply with data protection regulations. Solutions include implementing robust data governance and securing AI models with encryption techniques.

Model Training and Accuracy: Training AI models require high-quality, clean data. In financial services, where accuracy is critical, teams must invest in proper data preparation and frequent model validation to ensure reliable results.

Integration with Legacy Systems: Many FinServ applications rely on legacy software. Integrating Generative AI into these systems can be complex. Cloud-based AI services and APIs can bridge the gap between modern AI models and outdated infrastructure.

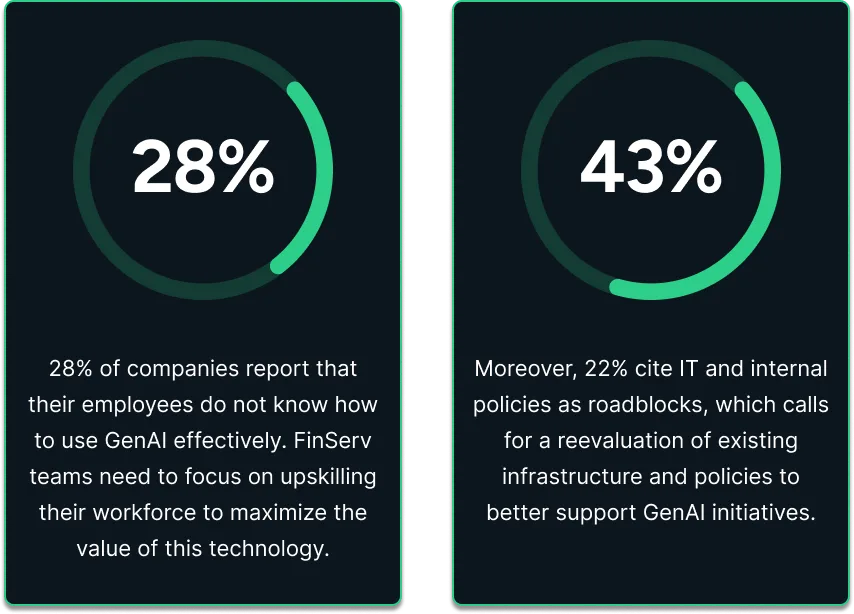

Resource Efficiency: The survey points out that 44% of respondents lack the necessary resources to deploy advanced GenAI models. You need to ensure you have both the computational power and skilled personnel required to make the most of these advanced technologies.

Barriers to Preventing Organizations From Delivering More Value From Data, Analytics, and AI

The Future of FinServ with AI at the Core

Generative AI is revolutionizing the way FinServ teams operate, driving efficiency, accuracy, and financial performance. The 2024 survey data clearly indicates that this technology is here to stay, with 90% of senior leaders already investing in GenAI across various budgets. While challenges such as resource constraints and employee knowledge gaps persist, the benefits far outweigh the barriers. With AI models becoming more sophisticated and advanced, FinServ professionals will evolve from number-crunchers to strategic decision-makers.

Are you ready to modernize? Yes or Maybe?

As you think of an answer to that and explore the potential of GenAI for your organization, Celestial Systems offers an excellent opportunity to deepen your understanding. Gain insights into leveraging AI for your business by watching the recording of our recent webinar, which covered a variety of important topics, including:

- AI Innovation – State of the Union (With Use Cases in Financial Services)

- Why Dataiku? – A CXO’s 15 Minute Tutorial

- Build a LLM in Under 5 Minutes

- Generative Maturity Quiz and Business Strategy Development for Driving Business Impact with GenAI Initiatives

References: Insights From 400 AI Leaders (by Dataiku) – https://pages.dataiku.com/dataiku-databricks-ai-today