As artificial intelligence (AI) adoption in the financial services sector accelerates, over 85% of banks globally are exploring or actively integrating AI solutions to enhance operations and improve customer experience. However, many of these institutions still rely on legacy systems, which creates challenges for seamless AI integration. This blog examines how banks can overcome these barriers by leveraging hybrid approaches, cloud technologies, and APIs to bring AI innovation into their traditional infrastructures. Backed by industry data, we’ll explore successful case studies, and the tangible benefits AI delivers—from reducing operational costs by 22% to improving fraud detection and personalized banking experiences.

Why is AI Integration Crucial for Legacy Banking Systems?

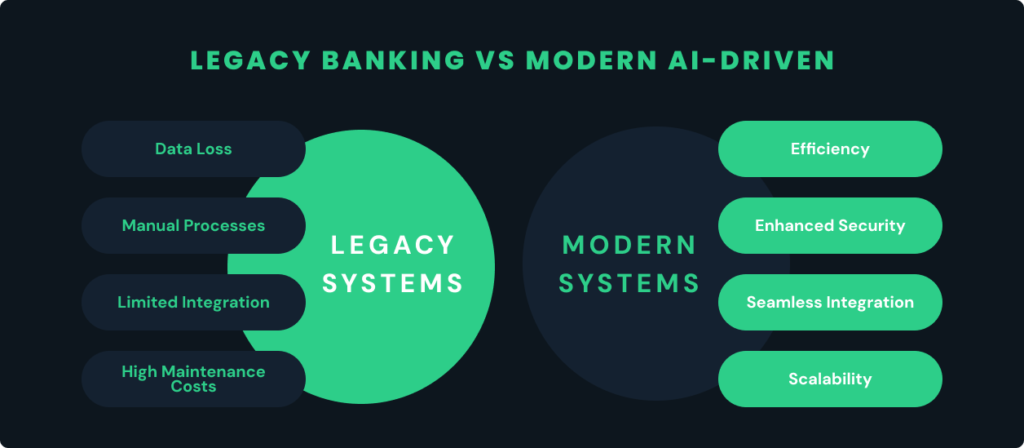

Modern banks are evolving from simple transactional platforms to digital experiences where customers expect instant responses and tailored services. However, many banks continue to use legacy systems, which, while reliable, are limited in their ability to support advanced analytics and AI.

AI Use Cases in the Banking Sector

Here are notable examples of how AI is being utilized in banking:

Customer Service Automation

AI-driven chatbots utilize natural language processing to address customer inquiries around the clock. With each interaction, these systems learn and adapt, improving their responses over time and enhancing overall customer satisfaction while freeing human agents to tackle more complex issues.

Credit Scoring and Risk Assessment

AI redefines creditworthiness assessment by considering a wider array of data points, including alternative metrics such as payment histories and social engagement. This comprehensive analysis facilitates more accurate risk evaluations, promoting fair lending practices and financial inclusion.

Portfolio Management

Robo-advisors powered by AI offer personalized investment guidance by assessing individual risk preferences alongside current market conditions. This data-centric strategy not only democratizes access to investment advice but also optimizes asset allocation for enhanced returns.

Process Automation

Through the automation of repetitive tasks such as data entry and document processing, AI significantly increases operational efficiency. By reducing manual workloads, banking professionals can redirect their focus toward strategic initiatives that drive growth.

Market Sentiment Analysis

AI tools analyze social media and news sentiment, providing banks with insights into public perception and market dynamics. This information can be crucial for making informed investment decisions that align with prevailing consumer sentiments.

Churn Prediction

Leveraging data analytics, AI can uncover patterns that signal potential customer churn. By proactively addressing these indicators, banks can implement targeted retention strategies, ultimately enhancing customer satisfaction and reducing turnover.

What Challenges Do Banks Face When Integrating AI into Legacy Systems?

The journey to AI integration is not without challenges. Banks face numerous hurdles, starting with lack of skilled workforce and compatibility issues. Most legacy systems are not designed to communicate with modern AI tools, making integration complex and time-consuming. The high costs associated with updating or replacing legacy systems also act as a deterrent for many financial institutions.

Furthermore, data silos—where information is stored across multiple, disconnected systems bring forth significant obstacles. Without unified data, training AI models becomes difficult, leading to inefficiencies in AI model deployment. Lastly, banks must also proactively deal with regulatory compliance and data security concerns. Strict industry regulations around data privacy and security must be addressed before any AI solutions can be deployed on a large scale.

How Can Banks Overcome Technical and Operational Hurdles in AI Integration?

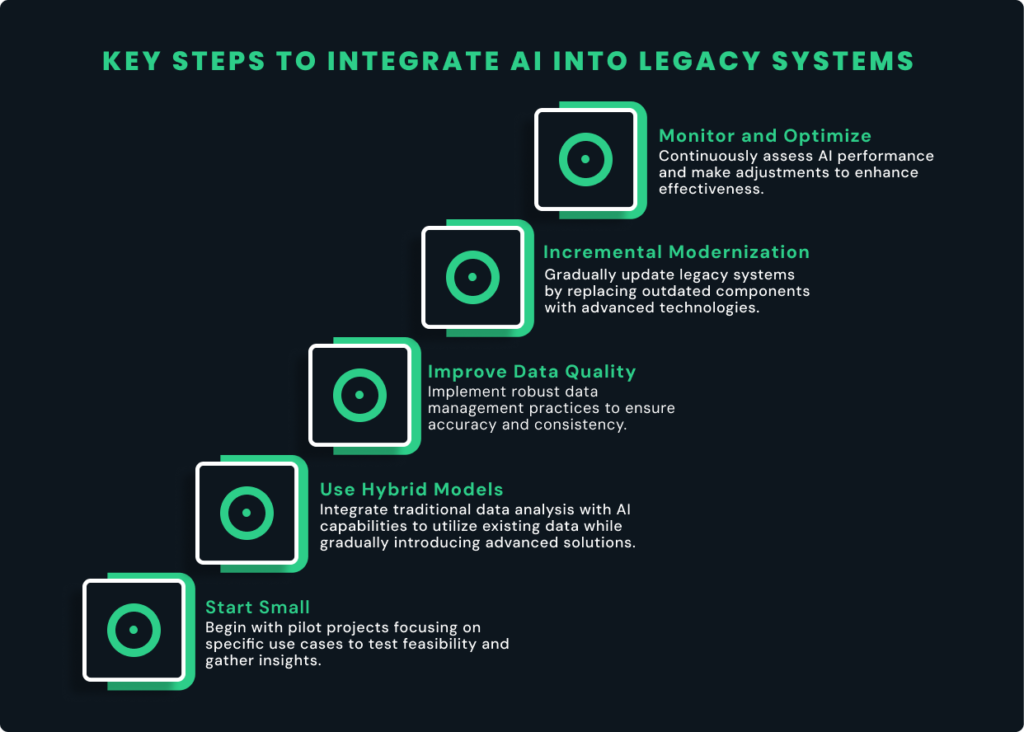

Despite the challenges, banks can take strategic steps to integrate AI into their legacy systems successfully. One of the most effective strategies is adopting a phased approach. Starting with smaller AI use cases, such as customer service chatbots or fraud detection models, allows banks to demonstrate immediate value without overhauling their entire infrastructure.

Roadmap to Successfully Integrate AI into Legacy Systems

Additionally, leveraging cloud infrastructure and APIs helps bridge the gap between outdated systems and modern AI platforms. Cloud-based solutions offer scalability, flexibility, and cost-effectiveness, which are crucial for supporting AI workloads. Celestial Systems has helped numerous banks modernize their infrastructure incrementally without disrupting daily operations. By offering services like Application Transformation and Infrastructure Modernization, we ensure seamless integration of AI technologies into legacy systems.

Banks can also adopt hybrid models, where core banking functions remain on legacy systems while AI workloads are shifted to modern platforms. This approach minimizes risk and avoids the need for a full system overhaul.

What Are the Key Benefits of Successfully Integrating AI into Banking Systems?

The successful integration of AI into legacy banking systems offers transformative benefits. First, it drives operational efficiency by automating routine tasks and providing faster, AI-driven decision-making processes. For example, AI models can analyze customer data in real-time, enabling banks to offer tailored financial products and services more rapidly.

Moreover, AI enhances the customer experience by enabling 24/7 support through intelligent chatbots and creating more personalized interactions. These advancements lead to higher customer satisfaction and retention rates.

Another significant advantage is the reduction of risk. AI systems can detect fraudulent activity in real-time, allowing banks to prevent fraud before it impacts their operations. Additionally, AI can predict IT infrastructure maintenance needs, helping banks avoid costly system downtimes.

Finally, AI integration offers banks greater scalability and flexibility in adopting future technologies. By modernizing their infrastructure with AI and cloud technologies, banks become more agile in responding to market changes and customer demands. Celestial Systems specializes in helping financial institutions avail themselves of the full potential of AI with its comprehensive suite of services, including Cloud AI and Data and Analytics.

Conclusion

According to a 2023 report by McKinsey, generative AI has the potential to contribute between $200 billion and $340 billion annually—representing 9% to 15% of banks’ operating profits—if its use cases are fully realized. As the banking industry faces rapid technological advancements and changing consumer expectations, the integration of AI into legacy systems is a necessity for long-term sustainability.

Banks must remain vigilant and proactive in adapting to these changes, fostering a culture of innovation, and continuously reassessing their strategies to meet future challenges. By adopting a phased approach, leveraging cloud solutions, and partnering with experienced service providers like Celestial Systems, banks can overcome these obstacles and pave the way for a future where AI drives innovation and growth in financial services. If you are ready to take the next step in your journey toward AI integration, reach out to our team today.

If you’re in Toronto on October 24, join us for our exclusive AI workshop in collaboration with Microsoft at the Microsoft Canada HQ, CIBC Square, 81 Bay St, Toronto! Discover how Financial Services Companies can do more with Data and AI. Learn about enhancing customer experiences, modernizing payments, improving risk management, and more through cutting-edge solutions.