Introduction

System reliability is critical in digital- first financial services. Even a few minutes of downtime can disrupt transactions, impact revenue, and damage customer trust. With increasing system complexity, financial institutions are turning to AI-driven SRE agents that can predict failures, automate responses, and optimize system performance in real time. Microsoft Fabric provides a unified platform to build these intelligent SRE agents, offering a structured approach to data ingestion, AI model training, real-time monitoring, and automation.

Why AI Agents for SRE in Banking?

Banks and financial institutions operate in a high-stakes environment, handling large volume of transactions and data, requiring always-on infrastructure. AI-driven SRE agents provide:

- Proactive Issue Resolution: Predict failures before they impact customers.

- Automated Remediation: Self-healing systems to resolve common incidents.

- Operational Efficiency: Reduced human intervention in repetitive tasks.

- Regulatory Compliance: Consistent adherence to financial industry standards.

- Enhanced Security: Early detection of threats and anomalies.

A 2023 survey by the Financial Services Information Sharing and Analysis Center (FS-ISAC) reported that 80% of banking institutions were exploring AI-driven automation for IT operations, with SRE automation among the top priorities.

Steps to Build an AI SRE Agent with Microsoft Fabric

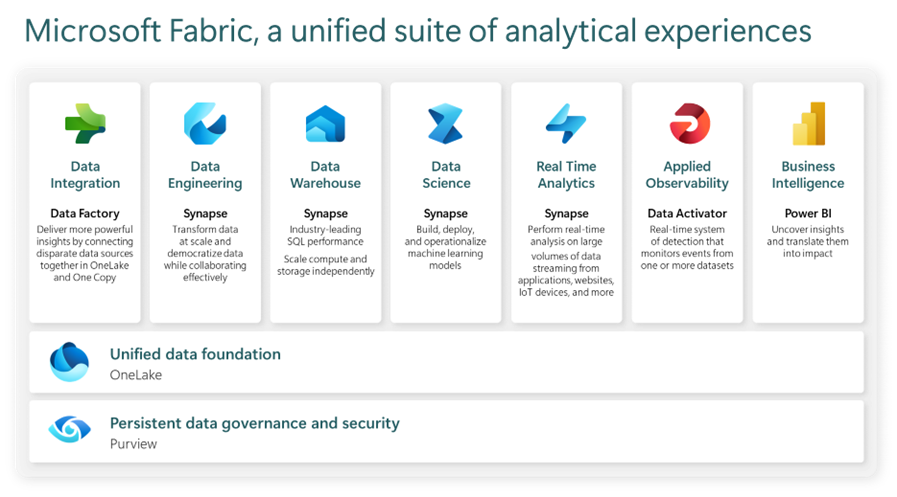

Microsoft Fabric offers a comprehensive ecosystem to build AI-driven SRE agents that can ingest data, detect anomalies, and automate incident response. Here’s how financial institutions can implement this step by step:

Step 1: Define Objectives and Use Cases

Identify key SRE pain points like what slows down response times? where do outages occur most frequently? and establish clear objectives, such as:

- Reducing incident resolution time

- Automating performance monitoring

- Implementing predictive maintenance

Step 2: Ingest and Process the Right Data

AI needs high-quality data to work effectively. Microsoft Fabric provides Data Factory and OneLake for seamless data ingestion. Banks can integrate logs, alerts, and metrics from diverse sources (cloud, on-prem, hybrid environments).

Step 3: Train and Deploy AI Models

Utilizing Synapse Data Science in Fabric, you can train AI models to:

- Detect anomalies in transaction volumes

- Predict potential system failures

- Classify incidents based on severity

Step 4: Implement Automated Incident Response

Using Fabric Event Streams and Microsoft Power Automate, AI agents can:

- Trigger self-healing actions

- Escalate incidents requiring manual intervention

- Alert relevant teams in real-time

Step 5: Monitor, Optimize, and Scale

With Fabric Real-Time Analytics, AI agents can continuously refine their algorithms, improving accuracy and efficiency over time.

Microsoft Fabric Tools for AI SRE Automation

Fabric integrates industry-leading technologies like Data Factory, Synapse, and Power BI into a single unified product for streamlining all your data and analytics workloads.

| Microsoft Fabric Component | Function |

| Data Factory | Data ingestion and integration from multiple sources |

| OneLake | Centralized storage for operational and transactional data |

| Synapse Data Science | AI model development and predictive analytics |

| Event Streams | Real-time data streaming for anomaly detection |

| Real-Time Analytics | Live monitoring and performance optimization |

| Power Automate | Orchestration of automated incident responses |

Challenges in Implementing AI SRE Agents

Despite the benefits, financial institutions face challenges such as:

- Data Silos: Integrating disparate systems and legacy infrastructure.

- Regulatory Compliance: Ensuring AI-driven decisions align with financial regulations.

- Security Concerns: Protecting sensitive financial data from AI vulnerabilities.

- Skill Gaps: Lack of in-house AI expertise to develop and maintain AI agents.

To succeed, financial institutions need the right tools, strategy, and expertise to overcome these hurdles.

Why Partner with Celestial Systems?

Celestial Systems Inc., a Microsoft Solutions Partner for Data & AI, has worked with leading banks, fintech firms, and financial institutions, helping them modernize IT operations, reduce downtime, and automate incident resolution. With deep expertise in Microsoft Fabric, cloud engineering, and AI-driven automation, Celestial helps banks overcome implementation challenges by:

- Designing end-to-end AI SRE solutions tailored to their infrastructure.

- Ensuring regulatory compliance with secure AI workflows.

- Seamlessly integrating Microsoft Fabric tools with existing IT operations.

- Providing ongoing support and optimization for AI-powered reliability management.

Business Benefits & ROI of AI-Driven SRE Automation

The impact of AI-powered SRE agents in financial services is clear:

- Higher Productivity: Automates incident resolution, freeing up IT teams for strategic tasks.

- Improved Customer Satisfaction: Faster issue resolution leads to better user experience.

- Reduced Downtime & Revenue Loss: Proactive monitoring minimizes disruptions.

- Regulatory Compliance: AI-driven processes ensure adherence to financial standards.

Given these benefits, AI-driven SRE automation is a low-hanging fruit for financial institutions, with a strong ROI from day one.

Conclusion

As financial services firms accelerate their digital transformation, AI-powered SRE agents built on Microsoft Fabric provide a smarter, proactive approach to operational resilience. Instead of reacting to failures, financial institutions can now predict, prevent, and automate responses, ensuring uninterrupted customer experiences. Partnering with Celestial Systems Inc. ensures financial organizations can successfully deploy, scale, and optimize AI-driven reliability solutions—unlocking higher efficiency, compliance, and business continuity.

Ready to transform your IT operations with AI? Get in touch with Celestial Systems today!

References

Here are some recommended readings to deepen your understanding of AI integration in Site Reliability Engineering (SRE) within the financial services sector:

- Bringing Reliability to Banking Services: A New Twist on Site Reliability Engineering

This article introduces the concept of “Service Reliability Engineering” (SvRE), which incorporates financial service regulatory requirements as part of providing a highly scalable and reliable digital banking service. redhat.com - Use Azure AI Services in Fabric

This Microsoft Learn article discusses how Fabric seamlessly integrates with Azure AI services, allowing you to enrich your data with prebuilt AI models without any prerequisites. learn.microsoft.com - Introducing Microsoft Fabric: Data Analytics for the Era of AI

This announcement unveils Microsoft Fabric—an end-to-end, unified analytics platform that brings together all the data and analytics tools that organizations need. azure.microsoft.com - Generative AI with Microsoft Fabric

This blog post explains how Microsoft Fabric seamlessly integrates with generative AI to enhance data-driven decision-making across your organization. techcommunity.microsoft.com

These resources offer valuable insights into the convergence of AI and SRE, particularly within the context of financial services, and provide practical guidance on leveraging Microsoft Fabric for enhanced reliability and efficiency.