Introduction

Health insurance claims processing has long been burdened by manual data entry, fragmented systems, and human errors that delay reimbursements and frustrate customers. As the industry shifts toward digital transformation, Artificial Intelligence (AI) is emerging as a game-changer—especially in automating data extraction and validation. Intelligent Document Processing (IDP) powered by AI is helping insurers streamline workflows, reduce operational costs, and enhance customer satisfaction.

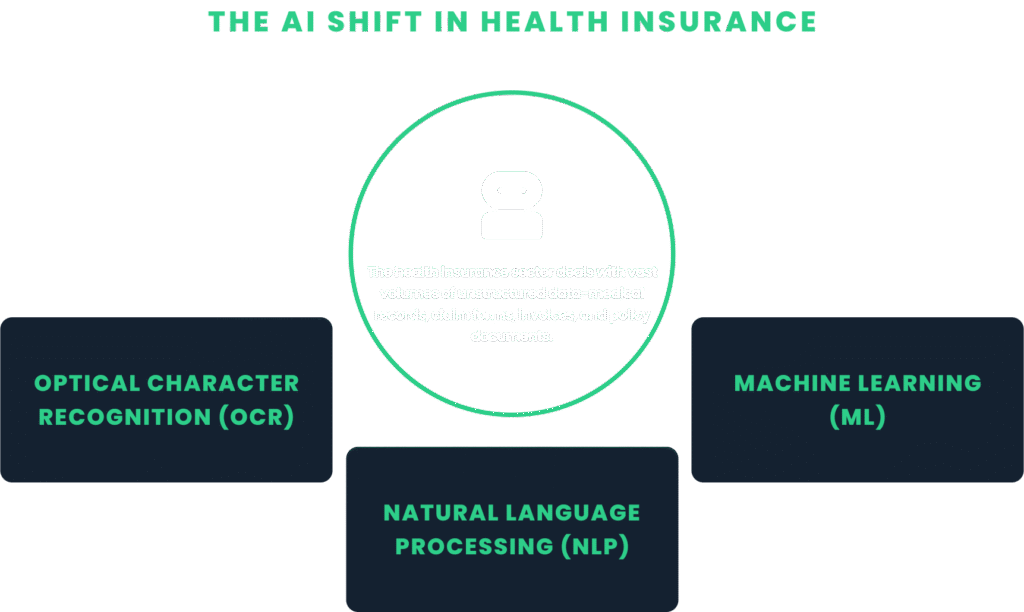

The Need: The AI Shift in Health Insurance

The health insurance sector deals with vast volumes of unstructured data—medical records, claim forms, invoices, and policy documents. Traditionally, processing these documents required manual review, which is time-consuming and error-prone. AI-driven IDP solutions use technologies like Optical Character Recognition (OCR), Natural Language Processing (NLP), and Machine Learning (ML) to extract, classify, and validate data with high accuracy.

This shift is not just about automation—it’s about intelligent automation that understands context, learns from patterns, and continuously improves.

Top 5 Ways Companies Are Improving Customer Experience Using AI

1. Automated Data Extraction from Complex Forms

AI-powered OCR tools can read and extract data from structured and semi-structured documents like HCFA forms, EOBs, and medical bills. NLP algorithms further interpret medical terminology and map it to standardized codes (ICD, CPT), reducing manual coding errors.

2. Real-Time Validation and Fraud Detection

Machine learning models can cross-verify extracted data against policy rules, historical claims, and external databases. This helps flag anomalies, detect potential fraud, and ensure compliance—before the claim moves forward.

3. Seamless Integration with Core Systems

Modern IDP platforms integrate with existing claims management systems, enabling end-to-end automation. APIs and connectors allow data to flow securely and efficiently, eliminating silos and manual handoffs.

4. Faster Turnaround Times

By automating repetitive tasks, insurers can process claims in hours instead of days. This not only improves operational efficiency but also enhances customer trust and satisfaction.

5. Continuous Learning and Improvement

AI models improve over time by learning from corrections and feedback. This means fewer errors, better accuracy, and smarter automation with each claim processed.

Accelerating Transformation with Celestial Systems and Dataiku

While the benefits of AI are clear, implementing and scaling these solutions can be complex. That’s where a Managed Service Partner like Celestial Systems comes in. With deep domain expertise and a unique partnership with Dataiku, Celestial helps insurers build and deploy AI-powered IDP solutions faster and more cost-effectively.

Celestial Managed Services provides direct access to the Dataiku enterprise AI platform—trusted by hundreds of global enterprises—as a fully managed service. Instead of shouldering high platform costs and staffing complexity, you gain a partner that delivers outcomes fast and keeps them running smoothly.

- Lower cost of entry: access enterprise AI without the high upfront licensing expense.

- Aligned to business priorities: every project is selected and delivered to move the needle on what matters most.

- Speed: production-ready in 8–12 weeks, with Celestial managing delivery and support.

- Industry-leading foundation: built on Dataiku technology powering innovation at leading global enterprises.

Dataiku’s collaborative data science platform enables rapid prototyping, model training, and deployment—all while ensuring governance and scalability. Combined with Celestial’s implementation and support services, insurers can shorten time to market, reduce total cost of ownership, and stay ahead of the curve.

Conclusion

AI-driven Intelligent Document Processing is revolutionizing health insurance claims by reducing manual errors, accelerating workflows, and enhancing customer experience. With the right tools and partners, insurers can unlock the full potential of automation and deliver smarter, faster, and more reliable services.

If you’d like to explore these ideas further, we’re hosting three upcoming sessions where we’ll dive deeper into AI adoption strategies:

- Unlocking Innovation with Microsoft AI – Lessons from Real-World Transformation – Join us for an exclusive Fireside Chat with Sachin Agarwal (Shiftboard) and Lakshmi Chandra (Celestial Systems). Get practical insights on Microsoft Fabric, Copilot, Azure OpenAI, and real-world ML/AI applications. Learn best practices, avoid pitfalls, and ask your questions live.

- The GenAI Advantage: Smarter, Safer Modernization in Financial Services – Join Dataiku and Celestial Systems to learn how leading financial institutions are safely and efficiently modernizing operations with GenAI, driving real-world impact through use cases like summarization, report generation, and customer service automation.

- Celestial Systems Workshop, Toronto – A chance to meet our team, see our latest solutions in action, and discuss how AI can be applied in your own organization.

We’d love for you to join the conversation.